The Economic Model 2

The formula and the way to measure offset multiplier effect through NLBS are provided on this post.Concerning the real B/S of B, next equation can be quoted.

The ratio represents the real value of the loan held by A to B(β≦α). The price which C should pay to purchase loan from A is γ, which compose next equation. This procedure is necessary to measure following multiplier effect.

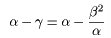

In this case multiplier effect(=α-γ) is as follows(formula1):

Next, concerning the real B/S of D, there exists the amount δ, which leads to next equation. The price which E should pay to purchase loan from C is γ. It is known that in fact the purchase price is not always γ, but it is permitted because if the deal should not been done, or if there exist the remainder, these offset profit will be taxed and absorbed by the government(when consecutive deal is done at γ2, (γ2-γ)will be taxed all). Usually γ consist the part of the payment to purchase next loan(in case deal is done at γ1, (γ-γ1)is supplemented by internal reserve of the economic unit). Please see figure 1, too.

In this case multiplier effect (=β-γ) is as follows(formula2):

And so, concerning the real B/S of F, there exist the amount ε, which leads to next equation.

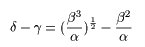

In this case multiplier effect (=δ-γ) is as follows(formula3):

In conclusion.

For each distribution, there exist each amount, which is expressed by next equation in general, for n≧3:

And for multiplier effect. We find next reccursive formula, for n≧4(formula4):

We can calculate the offset multiplier effect as on figure 2.

In general, for multiplier effect, next formula is quoted for n≧3:

In case of reverse wealth effect, as on the economic model edited on this blog June 09, 2005, the central bank can pass through the initial fund(=α-γ) to A and distribute to other economic unit. It is different from money supply. The central bank should play this role, as well as lender of last resort or provision of liquidity. Because every economic unit act based on both the real balance sheet and the expectation for the real balanace sheet, both are to be reformed through NLBS, by the central bank. There might be the case that the value lost in asset depreciation been covered to some extent by the initial fund provided by the central bank and it's multiplier effect, should there been no fear of inflation. This may leads to an equilibrium point in economy. Consequently the equilibrium point may be realized by the work of central bank as mentioned above. And as you can see on figure 2, it must be remarked that the earlier the central bank take action, the bigger the multiplier effect of initial A will be.